Competitive Dynamics

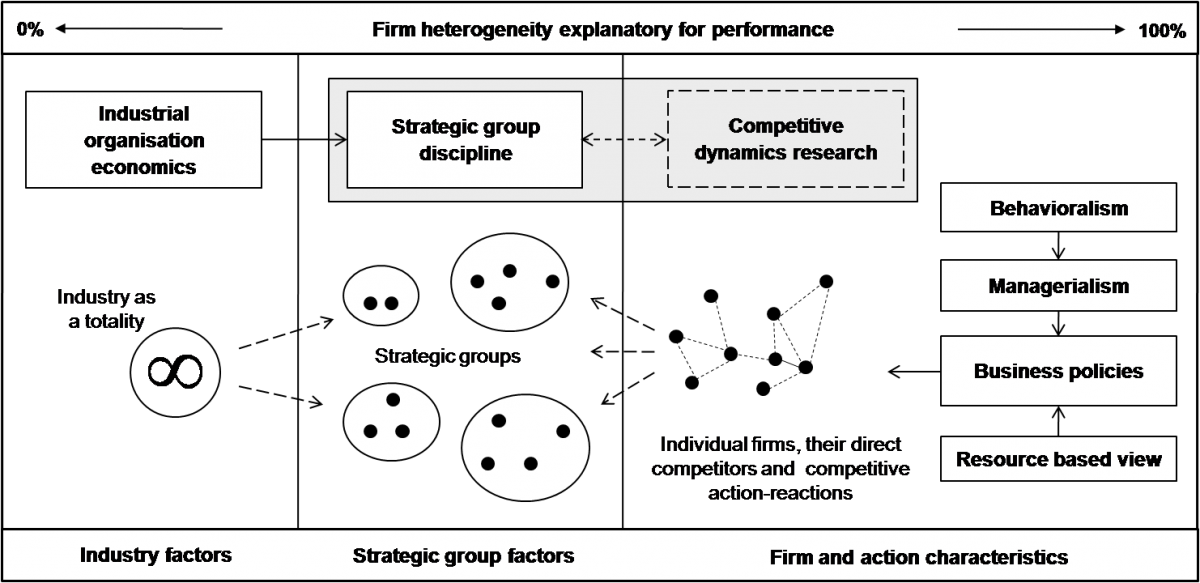

Competitive Dynamics is concerned with the causes and consequences of inter-firm rivalry (Thomas and Pollock, 1999; Young et al., 1996). To investigate the performance effects of competitive dynamics, competitive dynamics scholars have turned to economic competition theories and identified the dynamic exchange of competitive actions between firms as their object of interest. This contrasts with other more structural approaches to competition research, such as industrial organization. Figure 1 illustrates how competitive dynamics compares with other related theoretical perspectives.

Figure 1: Theoretical Perspectives on Interfirm Rivalry

Source: Schimmer (2012: 12)

On the Study of Competitive Actions

Contrasting the Industrial Organization's interest in structural industry characteristics, the competitive dynamics perspective focuses on the nature and consequences of competitive dynamics among firms (Ketchen et al., 2004). The perspective generally assumes a notion of competition matching the idea of Schumpeterian and Austrian economics (Kirzner, 1997; Mises, 1949) that "the fundamental impulse that sets and keeps the capitalist engine in motion comes from the new customers' goods, the new methods of production of transportation, the new markets, the new forms of industrial organization that capitalist enterprises create" (Schumpeter, 1943: 83-85). It thus opens up the black box of firm behavior and considers firm performance levels resulting from an ongoing struggle among firms (Kirzner, 1973).

To better express the action and turbulence inherent in the competitive interplay between firms and to set their interpretation of competition apart from the static notion present in economics, competitive dynamics scholars have revitalized the term "interfirm rivalry" (Bettis and Weeks, 1987; Porter, 1979) and created certain useful metaphors that illustrate the personal, goal-driven and dynamic notion of rivalry they maintain (Chen, 2009). Scholars described rivalry as a boxing fight (Ferrier and Lee, 2002), or, with a focus on a larger number of competitors, as a race where multiple rivals compete against each other while accelerating from time to time to overtake a specific opponent (Zuchhini and Kretschmer, 2011).

The inception of the competitive dynamics perspective dates back to the early 1980s when scholars initially put the dynamic, process-oriented notion of interfirm rivalry to an empirical test (Bettis and Weeks, 1987; MacMillan, McCaffrey, and Van Wijk, 1985). They pioneered an empirical approach that studies the competitive actions and responses of firms as the central vehicles of rivalry. Fueled by the research program of Professor Chen (1988, 1996; Chen and Hambrick, 1995; Chen and MacMillan, 1992; Chen and Miller, 1994; Chen et al., 1992), this research strand soon gained momentum and became an established area of research named "competitive dynamics research".

Early competitive dynamics studies investigated the defining characteristics of competitive moves and how these relate to responses by competitors (Chen and MacMillan, 1992; Chen and Miller, 1994; Chen et al., 1992). Important findings suggest that a shared market interest and similar resource profiles raise competitive tension between firms and that action characteristics, such as irreversibility, visibility, and competitor dependence on the challenged market, have predictive power for the competitor's response behavior (Chen, 1996; Chen and MacMillan, 1992; Chen and Miller, 1994). Scholars subsequently complemented the analysis of action-and-response combinations with the study of longer sequences of competitive moves (Chen and Hambrick, 1995; Ferrier, 2001; Gimeno and Woo, 1996; Hambrick, Cho and Chen, 1996; Miller and Chen, 1994, 1996b, 1996a; Rindova, Ferrier and Wiltbank, 2010). In comparison to the analysis of individual moves, which draws on the isolated characteristics of actions, the analysis of competitive action sequences sheds light on the effectiveness of competitive strategies as a whole. Ferrier, Smith, and Grimm (1999), for example, find that challengers have better chances to dethrone their market's leading firm with sequences of aggressive actions if the leading firm fails to keep up with the challenger, applies narrower action repertoires, or responds less aggressively.

Most recently, competitive dynamics research has taken a novel direction. It set out to expand its reach to market situations where the dyadic relationship between a focal firm and its main rival is not sufficiently instrumental for explaining the firm's competitive behavior (Hsieh and Chen, 2010; Zuchhini and Kretschmer, 2011). In other words, the most recent research efforts aim at developing an action-based theory of rivalry valid in competitive markets, where interfirm-relationships are numerous and individually less relevant for the choice and timing of competitive actions than presumed by prior research (Chen, 1996; Chen and MacMillan, 1992). Hsieh and Chen (2010) have pioneered such an expansion of the field's theoretical fundament and identified the recent competitive activity of all rivals as the major antecedent of a firm's inclination to take competitive action.

Capturing Firms' Competitive Behaviors

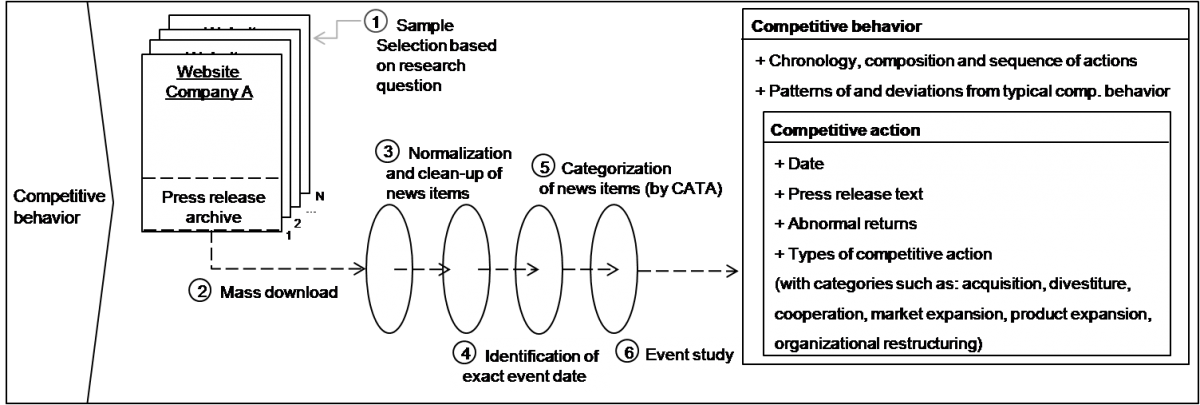

One key challenge in competitive dynamics research is to capture the competitive behavior of firms. Besides of manually mapping competitive actions of firms throughout time, automated procedures may help to get hold of firms' strategic decisions and rivalrous actions. One option to collect and identify the competitive actions of firms based on the firms' online press release archives and a subsequent sequence of steps to systematically map the competitive actions of individual firms or whole industries. Figure 2, taken from Schimmer (2012), illustrates this approach.

Figure 2: Capturing Competitive Behavior

Adapted from Schimmer (2012: 5)

Competitive Action Patterns and Stock Price Reactions

Firms and stock markets form an intimate relationship, also when it comes to the analysis of firm competitive behavior. One trending research theme is the analysis of how capital markets respond to different sequences of competitive actions. The underlying assumption of this research stream is that market participants can discriminate consistently from inconsistent competitive behaviors by observing the unfolding stream of competitive actions.

Video 1: Prof. Walter Ferrier Discussing Stock Market Responses to Gestalt Properties of Competitive Action Sequences

For more details on this approach and how it can be used to publish innovative research, please refer to Schimmer (2012).

References

Bettis, R. A. and Weeks, D. 1987. 'Financial returns and strategic interaction: The case of instant photography'. Strategic Management Journal, 8: 549-563.

Chen, M. J. 1988. Competitive strategic interaction: A study of competitive actions and responses. Unpublished doctoral dissertation, University of Maryland.

Chen, M. J. and MacMillan, I. 1992. 'Nonresponse and delayed response to competitive moves: The roles of competitor dependence and action irreversibility'. Academy of Management Journal, 35: 539-570.

Chen, M. J., Smith, K. D. and Grimm, C. M. 1992. 'Action characteristics as predictors of competitive responses'. Management Science, 38: 439-455.

Chen, M. J. and Miller, D. 1994. 'Competitive attack, retaliation, and performance: An expectancy-valence framework'. Strategic Management Journal, 15: 85-102.

Chen, M. J. and Hambrick, D. C. 1995. 'Speed, stealth, and selective attack: How small firms differ from large firms in competitive behavior'. Academy of Management Journal, 38: 453-482.

Chen, M. J. 1996. 'Competitor analysis and interfirm rivalry: Toward a theoretical integration'. Academy of Management Review, 21: 100-134.

Chen, M. J. 2009. 'Competitive dynamics research: An insider's odyssey'. Asia Pacific Journal of Management, 26(1): 5-25.

Ferrier, W. J., Smith, K. G. and Grimm, C. M. 1999. 'The role of competitive action in market share erosion and industry dethronement: A study of industry leaders and challengers'. Academy of Management Journal, 42: 372-388.

Ferrier, W. J. 2001. 'Navigating the competitive landscape: The drivers and consequences of competitive aggressiveness'. Academy of Management Journal, 44: 858-877.

Ferrier, W. J. and Lee, H. 2002. 'Strategic aggressiveness, variation, and surprise: How the sequential pattern of competitive rivalry influences stock market returns'. Journal of Managerial Issues, 14: 162-180.

Gimeno, J. and Woo, C. Y. 1996. 'Hypercompetition in a multimarket environment: The role of strategic similarity and multimarket contact in competitive de-escalation'. Organization Science, Vol. 7: 322-341.

Hambrick, D. C., Cho, T. and Chen, M. 1996. 'The influence of top management team heterogeneity on firms' competitive moves'. Administrative Science Quarterly, 41: 659-684.

Hsieh, K.-Y. and Chen, M.-J. 2010. 'Responding to rivals' actions: Beyond dyadic conceptualization of interfirm rivalry'. 2010 Academy of Management Annual Meeting. Montreal, Canada.

Ketchen, D. J., Snow, C. C. and Hoover, V. L. 2004. 'Research on competitive dynamics: Recent accomplishments and future challenges'. Journal of Management, 30(6): 779-804.

Kirzner, I. 1973. 'Competition and Entrepreneurship'. Chicago: University of Chicago Press.

Kirzner, I. M. 1997. 'Entrepreneurial discovery and the competitive market process: An Austrian approach. Journal of Economic Literature, 35(1): 60-85.

MacMillan, I., McCaffrey, M. and Van Wijk, G. 1985. 'Competitor's responses to easily imitated new products: Exploring commercial banking product introductions'. Strategic Management Journal, 6: 75-86.

Miller, D. and Chen, M. J. 1994. 'Sources and consequences of competitive inertia: A study of the US airline industry'. Administrative Science Quarterly, 39(1): 1-23.

Miller, D. and Chen, M. J. 1996a. 'Nonconformity in competitive repertoires: A sociological view of markets'. Social Forces, 74: 1209-1234.

Miller, D. and Chen, M. J. 1996b. 'The simplicity of competitive repertoires: An empirical analysis'. Strategic Management Journal, 17(6): 419-439.

Mises, L. 1949. 'Human action: A treatise on economics'. New Haven: Yale University Press.

Porter, M. 1979. 'The structure within industries and companies' performance'. Review of Economics and Statistics, 61: 214-227.

Rindova, V., Ferrier, W. J. and Wiltbank, R. 2010. 'Value from gestalt: How sequences of competitive actions create advantage for firms in nascent markets'. Strategic Management Journal, 31(13): 1474-1497.

Schendel, D. and Hofer, C. W. 1979. 'Strategic management: A new view of business policy and planning'. Boston, MA: Little Brown.

Schimmer, M. 2012. 'Essays on competitive dynamics: Strategic groups, competitive moves and performance within the global insurance industry'. Dissertation, University of St. Gallen, St. Gallen.

Schumpeter, J. 1943. 'Capitalism, socialism, and democracy'. New York: Harper.

Thomas, H. and Pollock, T. 1999. 'From IO economics SCP paradigm through strategic groups to competence-based competition: Reflections on the puzzle of competitive strategy'. British Journal of Management, 10(2): 127-140.

Young, G., Smith, K. G. and Grimm, C. M. 1996. '"Austrian" and industrial organization perspectives on firm-level competitive activity and performance'. Organization Science, 7: 243-254.

Zuchhini, L. and Kretschmer, T. 2011. 'Competitive pressure: Competitive dynamics as reactions to multiple rivals'. Annual Meeting of the Academy of Management. St. Antonio, TX.