Correct Use of Event Studies in Securities Litigation

by Pavitra Kumar and Torben Voetmann

An event study analyzes the effects of economic events on security prices. In efficient markets where prices reflect all publicly available information and expected cash flows, any new value-relevant information that impacts investors’ assessment of future cash flows will be reflected immediately.[1] Therefore, one can measure the economic effect of an event using prices over a relatively short time period.[2]

After the Supreme Court endorsed the fraud-on-the-market doctrine in Basic v. Levinson[3] in 1988, event studies became widely used in securities litigation to assess claims of loss causation as well as evaluate the “materiality” of alleged misstatements or fraudulently omitted information.[4] In the recent Halliburton II decision (Halliburton Co. v. Erica P. John Fund, Inc., No. 13-317) the Supreme Court explicitly contemplated the use of event studies by defendants in class certification to rebut the presumption of reliance:

“Suppose a defendant at the certification stage submits an event study looking at the impact on the price of its stock from six discrete events, in an effort to refute the plaintiffs’ claim of general market efficiency.... Suppose one of the six events is the specific misrepresentation asserted by the plaintiffs....[and] the evidence shows no price impact with respect to the specific misrepresentation challenged in the suit. The evidence at the certification stage thus shows an efficient market, on which the alleged misrepresentation had no price impact.”[5]

Consequently, future class certification decisions are more likely to involve the adjudication of competing event study analyses to determine the price impact of alleged corrective disclosures. Experts will thus need to consider more carefully the limitations of traditional event study analysis as well as recent developments in the field.

TRADITIONAL EVENT STUDIES

The primary purpose of an event study is to determine whether a particular event is associated with a significant change in price. In securities litigation, the typical example of a loss-inducing event is a corrective disclosure by a company. A corrective disclosure corrects one or more of a company’s previous statements that allegedly were false or misleading. Event studies thus help determine two critical links between alleged misrepresentations or omissions made by a defendant and the damages allegedly suffered by the plaintiff class:

- First, event studies determine whether an alleged misrepresentation or corrective disclosure was associated with a price impact;

- Second, if there was a price impact, event studies determine how much of this price impact was potentially caused by the alleged misrepresentation or corrective disclosure as opposed to other, unrelated factors.

The effort to resolve these issues using financial econometrics and statistical techniques is a major advantage of event study analysis. However, a key question is how to exclude confounding events to isolate the portion of price movements resulting only from the disclosure of interest.

EVENT STUDY PROCEDURE

Event studies traditionally examine daily returns and follow an established procedure:[6]

- Event definition: Define the event of interest (that is, the news announcement or disclosure of interest) for the subject company and identify the period over which to examine the event (the “event window”);

- Expected and residual returns: Determine a method to calculate the “normal” or “expected” return for the subject company over the event window. The expected return is also referred to as the “conditional expected return,” or the expected return conditional on that day’s observed market and industry returns. The difference between this expected return and the company’s actual return is the residual return (or abnormal return);

- Estimation and testing procedure: Choose an appropriate period over which to estimate expected returns. The standard approach is to run a regression model to isolate the firm-specific stock price return (the percentage daily price change) after controlling for effects of the market, the firm’s industry, and, if appropriate, other relevant non-firm-specific factors.

- Statistical inference: Conduct a statistical test to determine whether the residual firm-specific return is significantly different from zero on the event date. If the information released on the event day is value-relevant to an investor, the residual return should be statistically significantly different from zero. The goal here is to avoid improperly rejecting the possibility that the return reflects normal fluctuations and not the event. To address this problem, the observed return should be sufficiently large that this mistake only occurs a small percentage of the time. This percentage is the significance level or size of the test.[7] Notably, a statistically significant[8] residual return is consistent with the arrival of new company-specific information, but need not result from fraud-related, company-specific information.

XYZ Corporation Case Study

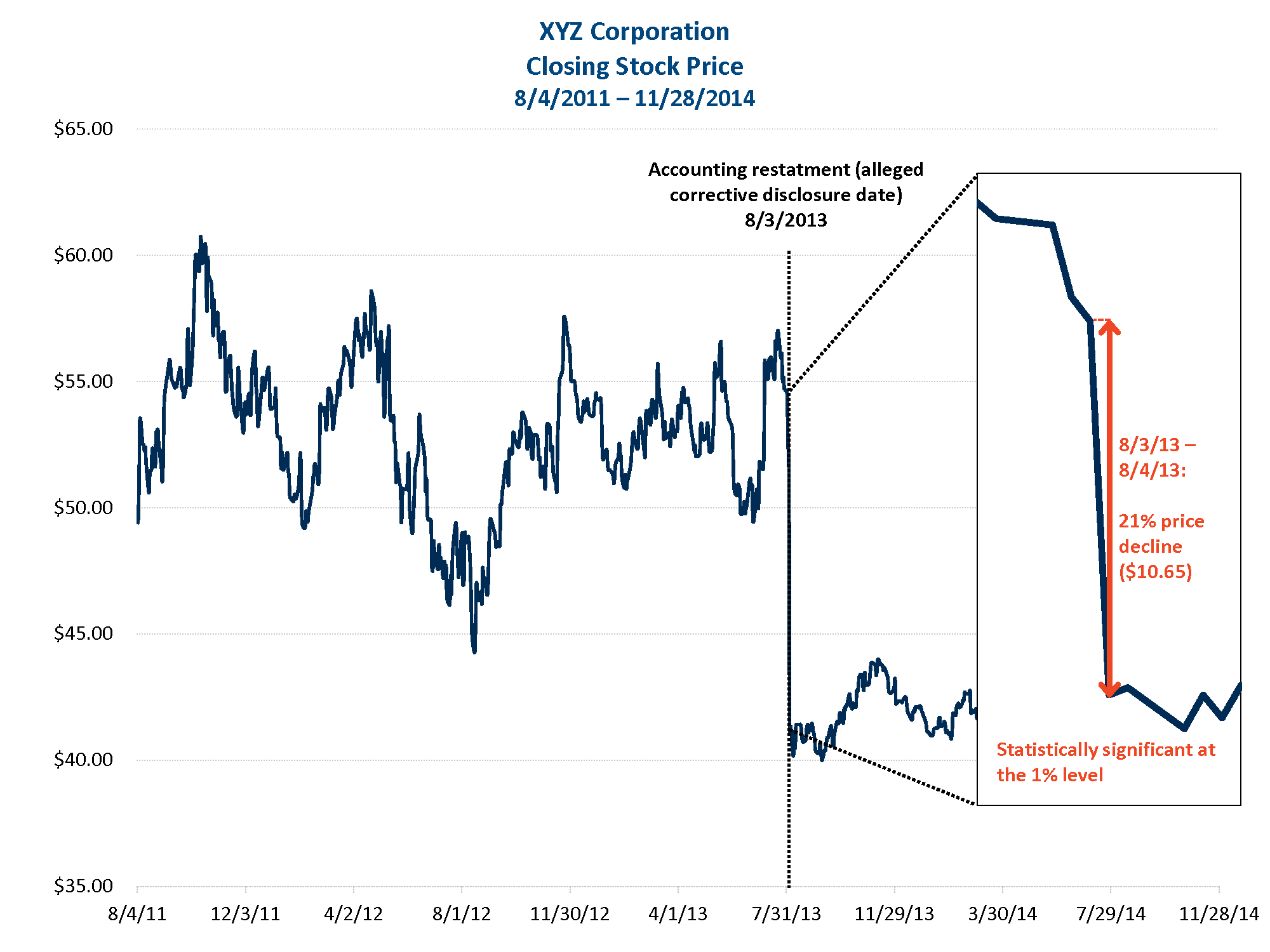

XYZ Corporation had an alleged corrective disclosure related to an accounting restatement on August 3, 2013 (the “event date”). On the event date, there was a 21% decline in XYZ’s daily stock price, which was statistically significant at the 1% level.

Figure 1

Estimation of Residual Returns for XYZ Corporation

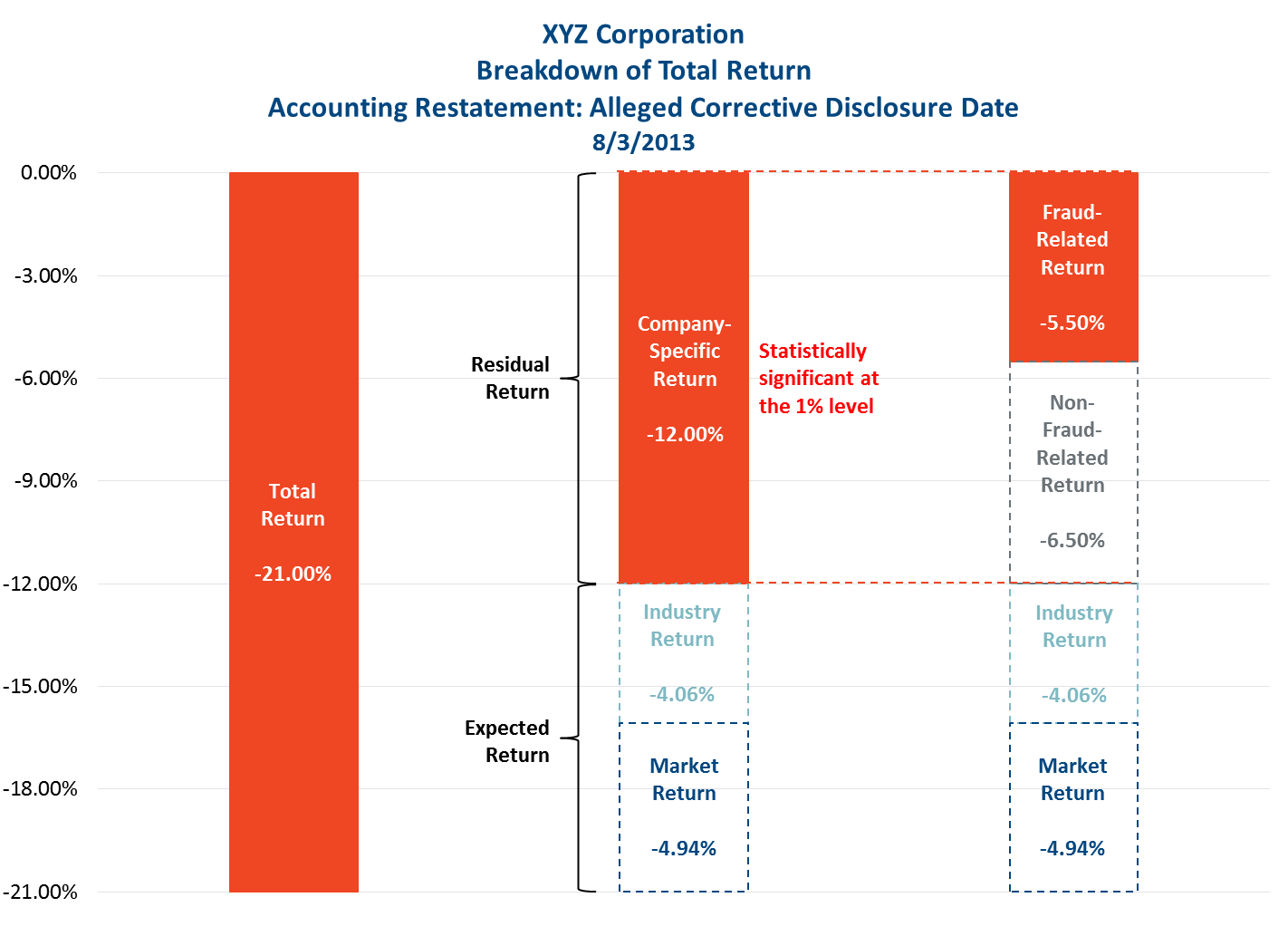

The illustration below shows that on the event date of August 3, 2013, XYZ’s actual negative daily stock return of 21% is comprised of its expected return (the sum of the return associated with market and industry movements) and the residual, company-specific return. The latter is equal to -12% and is statistically significant at the 1% level.

One can further decompose this company-specific return of -12% into the portion resulting from fraud-related information (-5.5%). For example, suppose the alleged corrective disclosure was a correction in XYZ’s actual earnings per share numbers. The fraud-related component of that disclosure is just the “earnings surprise” conveyed to the market; i.e., the difference between the new corrected earnings per share and the market’s previous expectations for XYZ’s earnings per share, rather than the new earnings level. One could disentangle the fraud-related surprise component using an earnings-response coefficient model, which determines the impact of earnings surprises on residual stock returns.[9] If this fraud-related portion of the return is also statistically significant, this indicates that the release of the fraud-related information (in this case, the earnings correction) had a material impact on the company’s stock price.

Figure 2

Some issues that experts need to consider when conducting a traditional event study include:

- Isolating value-relevant information when there are multiple confounding events;

- Estimating value-relevant information that is revealed gradually;

- Dealing with securities that are thinly traded;

- Addressing materiality and price impact when markets are potentially informationally inefficient;

- Estimating materiality through event studies when the model structure is changing, e.g., when the volatility of residual returns is changing, such as during the recent financial crisis; and

- Establishing causality chains and issues that arise for damages estimations.

Traditional event studies enable experts to disentangle fraud from non-fraud-related information on disclosure days using daily returns. Failing to distinguish the fraud versus non-fraud causes of price decline is a critical error. This becomes even more difficult when there are multiple confounding disclosures on the same day. Courts have recognized the possibility of studying intraday returns when this is the case.[10] Intraday event studies mark a departure from traditional daily event studies. We explore this topic in the next section.

INTRADAY EVENT STUDIES

A properly conducted event study provides a scientific and reliable methodology to establish evidence demonstrating the immediate cause-and-effect relation of market efficiency.[11] There is substantial evidence that one can measure a news event’s economic impact using asset returns at short time horizons. This has led to the increased use of high-frequency intraday data to disentangle intraday confounding events. Several academic analyses have shown that intraday event studies detect significantly smaller price changes than daily event studies[12] and thus allow for a more precise estimation of stock market responses to information.[13] Evidence also suggests that macroeconomic news announcements affect price movements across various markets immediately after their release.[14],[15],[16] The horizons of price responses to various types of news can be as short as seconds.[17]

High-frequency traders have exploited this immediate impact of news on prices in today’s computerized markets. Trading speeds have increased dramatically over the last 15 years, from an average round-trip order execution time of several seconds in the early 2000s to micro- and even nanoseconds in recent times.[18]

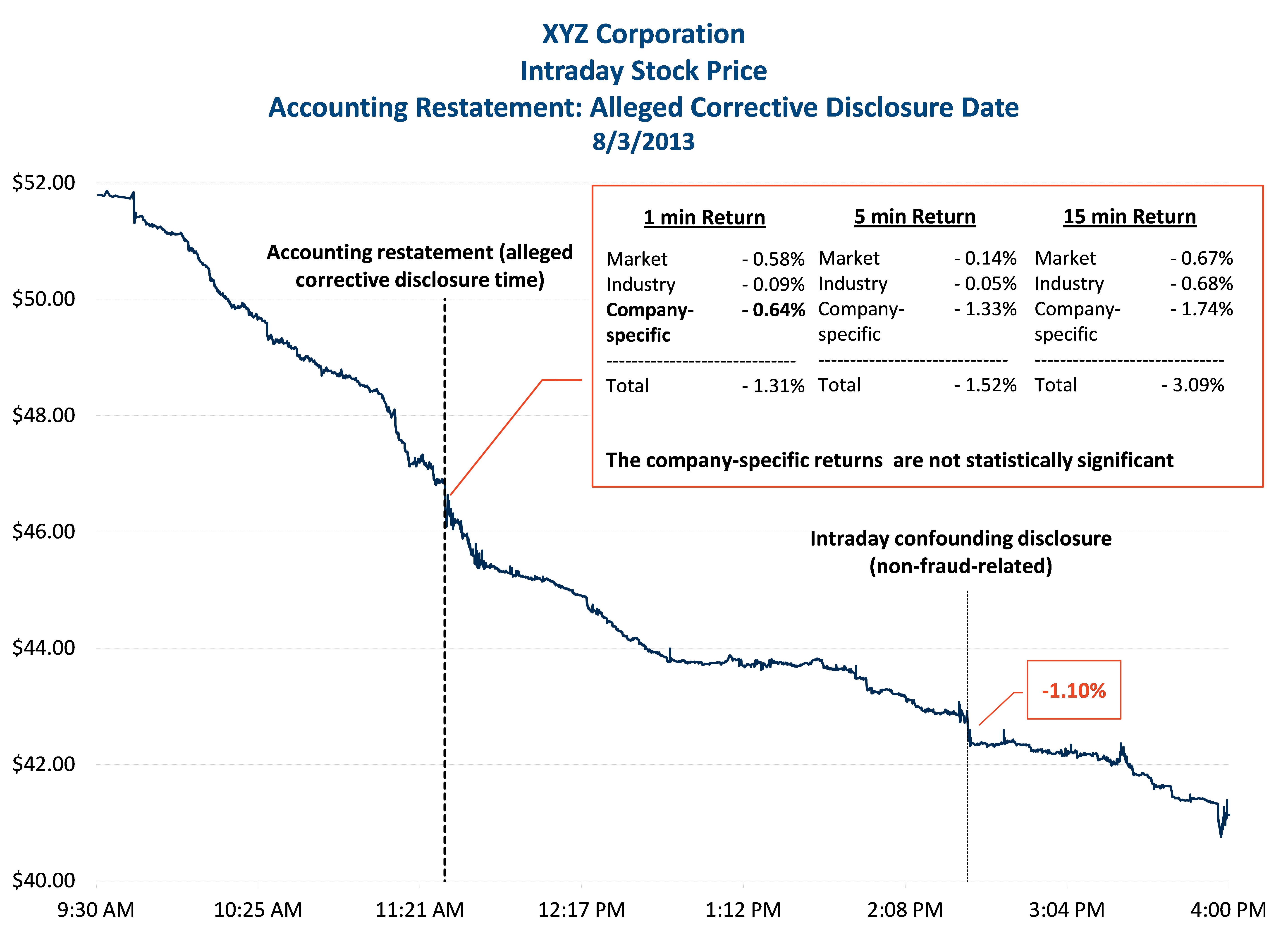

Illustration of Intraday Confounding Events for XYZ Corporation

The chart below displays two intraday events on August 3, 2013, the event date of interest for XYZ Corporation. The first event, just after 11:21 a.m. corresponds to the exact time of XYZ’s alleged corrective disclosure, and produces a total stock price drop of 1.31% (using 1-minute returns). Of this -1.31% return, -0.64% is the residual company-specific return for XYZ. This residual return is not statistically significant, using 1-minute, 5-minute, or 15-minute returns. However, the company-specific residual return for the whole day, as shown in the textbox above (-12%), is statistically significant at the 1% level. This discrepancy in magnitude and significance between the daily and intraday returns is primarily due to other non-fraud-related disclosures that occurred on the same day.

Figure 3

The second intraday event on August 3, 2013, illustrated above, occurred between 2 and 3 pm with a further stock price drop of just over 1%. This drop was unrelated to the earlier alleged corrective disclosure. Thus, it is necessary to disentangle the effect of the second intraday confounding event in order to isolate the portion of XYZ’s price movement resulting only from the disclosure of interest (the -0.64% drop using 1-minute returns). If one just examined the daily returns on this event date, one would falsely conclude that XYZ’s residual return was statistically significant and the alleged corrective disclosure had a material impact on its stock price. One reaches the opposite conclusion, however, by zooming in closer to the exact time of the alleged corrective disclosure.

The examples above highlight the usefulness of intraday data in event studies. As well as constructing more precise returns and disentangling intraday confounding events, experts also need to draw statistical inferences from intraday data. In efficient markets, stock price movements are unpredictable and introduce risk (i.e., volatility). Thus, market practitioners should measure such risk at high-frequency intervals in order to, first, reflect changes in the overall level of market and stock risk over time, and, second, account for intraday risk patterns. Changes in the expected volatility can then be used to conduct and enhance traditional statistical inference in event studies.

CONCLUSION

Nearly thirty years after Basic v. Levinson, it is surprising that class certification rulings on the conduct of event studies have been rare, even though event studies in general have been the subject of some court decisions.[19] The Halliburton II class certification decision, despite reflecting case-specific assessments of the expert evidence, provides a benchmark for how courts may adjudicate event study evidence of price impact going forward. While defendants could choose not to present economic evidence on price impact at the class cert stage for tactical reasons, it will likely be appealing to knock out certain alleged corrective disclosures and potentially trim the class. Halliburton II thus focuses the class certification battle on opposing experts’ event studies, with judges deciding on economic, econometric, and statistical inference issues. As such, the correct application of the event study methodology could be a focal point of future class certification proceedings.

Traditional event studies use daily data to determine, respectively, the link between alleged misrepresentations or omissions and price impact, and the portion of that price impact related to the alleged fraud. In order to do this, it is critical to distinguish fraud-related from confounding non-fraud-related events on disclosure days. This task is even more complicated if there are multiple confounding disclosures on the same event day. In these cases, intraday data may enable experts to assess more accurately the immediate price impact of news events. Experts will also need to develop reliable techniques to draw statistical inferences from intraday data. This combination of intraday data and dynamic volatility analysis is likely to be another major area of focus in upcoming securities litigation.

AUTHORS

PAVITRA KUMARSenior AssociateSan Francisco+1.415.217.1029Pavitra.Kumar@brattle.com

PAVITRA KUMARSenior AssociateSan Francisco+1.415.217.1029Pavitra.Kumar@brattle.com

Dr. Kumar is an economist with expertise in corporate finance issues including business valuation, securities and market microstructure. Since joining Brattle in 2009, she has conducted financial statement and valuation analysis in bankruptcy disputes, evaluated structured investments in tax litigation, and quantified business damages in a variety of scenarios. Dr. Kumar is also regularly involved in marketing initiatives and litigation projects concerning complex financial instruments. She has co-authored a recent academic journal article on the nature and impacts of high-frequency trading and a previous paper on the credit rating agencies’ role in failed structured finance instruments.

TORBEN VOETMANNPrincipalSan Francisco+1.415.217.1000Torben.Voetmann@brattle.com

TORBEN VOETMANNPrincipalSan Francisco+1.415.217.1000Torben.Voetmann@brattle.com

Dr. Voetmann works on complex economic and financial issues involving debt, equity, and derivative securities. He has testified and consulted on cases related to accounting, corporate finance, capital markets, financial institutions, insider trading, and internal investigations (including performing financial and economic analyses of “big data”). He focuses on issues related to financial econometrics (i.e., the application of statistical methods within an econometric framework) and market efficiency and materiality in securities fraud and misrepresentation cases. Dr. Voetmann has also testified and consulted on valuation issues related to mergers and acquisitions, appraisal actions, and other disputes involving valuation of private and public companies, illiquid securities, employee stock options, and minority interests.

Acknowledgement: The authors give special thanks to Andrea Kwan, a former intern at The Brattle Group.

ABOUT US

The Brattle Group provides consulting and expert testimony in economics, finance, and regulation to corporations, law firms, and governments around the world. We aim for the highest level of client service and quality in our industry. We are distinguished by our credibility and the clarity of our insights, which arise from the stature of our experts, affiliations with leading international academics and industry specialists, and thoughtful, timely, and transparent work. Our clients value our commitment to providing clear, independent results that withstand critical review.

For more information, please visit brattle.com.

[1] Brealey, Richard A., Stewart C. Myers and Franklin Allen, Principles of Corporate Finance, 11th Edition, New York: McGraw-Hill/Irwin (2013), Chapter 6, p. 131. The text states that “only cash flow is relevant” to making investment decisions.

[2] Campbell, John Y., Andrew W. Lo and A. Craig MacKinlay, The Econometrics of Financial Markets, Princeton University Press (1997), Chapter 4, p. 149.

[3] Basic Inc. v. Levinson, 485 U.S. 224 (1988).

[4] Ferrell, Allen and Atanu Saha, “The Loss Causation Requirement for Rule 10b-5 Causes-of-Action: The Implication of Dura Pharmaceuticals v. Broudo,” August 2007, Harvard Law and Economics Discussion Paper No. 596, p. 5.

[5] Halliburton Co. v. Erica P. John Fund, Inc., No. 13-317, June 23, 2014, (Halliburton II), pp. 19-20. Emphasis added.

[6] Campbell, Lo, and MacKinlay, op. cit., Chapter 4, pp. 150-152.

[7] This percentage represents the probability of concluding that the event caused a price impact when it did not. This is called a “Type I” error. It is common to fix the size of a test at 5%. See Brav, Alon and J.B. Heaton, “Event Studies In Securities Litigation: Low Power, Confounding Effects, And Bias,” March 2015, p. 11.

[8] The statistical significance of residual returns is measured by their t-statistics which account for the normal variation in the stock price. A t-statistic of 1.96 or greater in absolute value signifies that there is a 5% chance or less that the residual return was simply the result of normal variation in the stock price. Such residual returns are described as being statistically significant with 95% confidence, or significant at the 5% level.

[9] See, e.g., Cornell, Bradford, and Wayne R. Landsman, “Security Price Response to Quarterly Earnings Announcements and Analysts’ Forecast Revisions,” The Accounting Review, Vol. LXIV, No. 4, 1989, pp. 680-692.

[10] See Bricklayers and Trowel Trades Int’l Pension Fund v. Credit Suisse First Boston, 853 F. Supp. 2d 181, 190 (D. Ma. 2012) (citing Laura Starks, Discussion of Market Microstructure: An Examination of the Effects on Intraday Event Studies, 10 CONTEMP. ACCT. RES. 355, 383-86 (1994)); Esther Bruegger and Frederick C. Dunbar, Estimating Financial Fraud Damages With Response Coefficients, 35 J. CORP. L. 11, 13 (2009); and In re Novatel Wireless Sec. Litig., 910 F. Supp. 2d at 1218-21 (examining objections to expert’s intraday causation analysis in detail and holding that the testimony was admissible).

[11] See, e.g., Ross, Stephen. A., Randolph W. Westerfield and Jeffrey F. Jaffe, Corporate Finance, Burr Ridge, Richard D. Irwin, Inc. (2007), p. 371.

[12] Mucklow, Belinda, “Market Microstructure: An Examination of the Effects on Intraday Event Studies,” Contemporary Accounting Research, Vol. 10, No. 2, 1994, pp. 355-382.

[13] Starks, Laura T., “Discussion of “Market Microstructure: An Examination of the Effects on Intraday Event Studies,” Contemporary Accounting Research, Vol. 10, No. 2,1994, pp. 383-386.

[14] Andersen, Torben G. and Tim Bollerslev, “Deutsche Mark-Dollar Volatility: Intraday Activity Patterns, Macroeconomic Announcements, and Longer Run Dependencies,” Journal of Finance, Vol. LIII, No. 1, 1998, pp. 219-265.

[15] Andersen, Torben G., Tim Bollerslev, Francis X. Diebold and Clara Vega, “Real-time price discovery in global stock, bond and foreign exchange markets,” Journal of International Economics, Vol. 73, 2007, pp. 251-277.

[16] Hotchkiss, Edith S. and Tavy Ronen, “The Informational Efficiency of the Corporate Bond Market: An Intraday Analysis,” The Review of Financial Studies, Vol. 15, No. 5, 2002, pp. 1325-1354.

[17] Busse, Jeffrey A. and Clifton T. Green, “Market Efficiency in Real-Time,” Journal of Financial Economics, Vol. 65, No. 3, 2002, pp. 415-437.

[18] Goldstein, Michael A., Pavitra Kumar and Frank C. Graves, “Computerized and High-Frequency Trading,” The Financial Review, Vol. 49, No. 2, 2014, pp. 177-202.

[19] See e.g., In re Seagate Technology II Securities Litigation, C-89-2498(A)-VRW (N.D. Cal. 1994).