Overview of Research Applications

The event study methodology (ESM) was originally developed as a statistical tool for empirical research in accounting and finance (Ball & Brown 1968; Fama et al. 1969). Since then, the method has migrated to other disciplines, including economics, marketing, strategy research, information technology/systems, law (Bhagat and Romano, 2002a, 2002b, 2007), and political science.

With the different disciplines, various event types have moved into the scholarly focus. One way of classifying the overall body of event studies is to classify the studies according to the analyzed events. This yields two broad categories: economy-wide events (i.e., market shocks, such as regulatory change or catastrophic events) that impact a whole industry, and firm-specific events (i.e., corporate decisions or events) that impact individual firms.

As the overall body of event studies comprises several thousand studies, this website only provides a rough overview of the major research themes investigated. Whenever possible, the research streams are presented to you by expert scholars. The overview is structured along the following topic areas, with a first block entailing multi-event type studies, and a second block representing single event type studies.

Multi event type studies

- Stock market responses to economy-wide events (i.e., market shocks, regulations)

- Comparative analyses of event types

- Competitive dynamics / Interfirm rivalry

Single event type studies

- Dividends and earnings announcements

- Mergers & acquisitions

- New stock issues

- Index reconstitutions (i.e., stock additions / deletions to indices)

- Tender offers and stock repurchases

- Alliances and joint ventures

- Divestitures

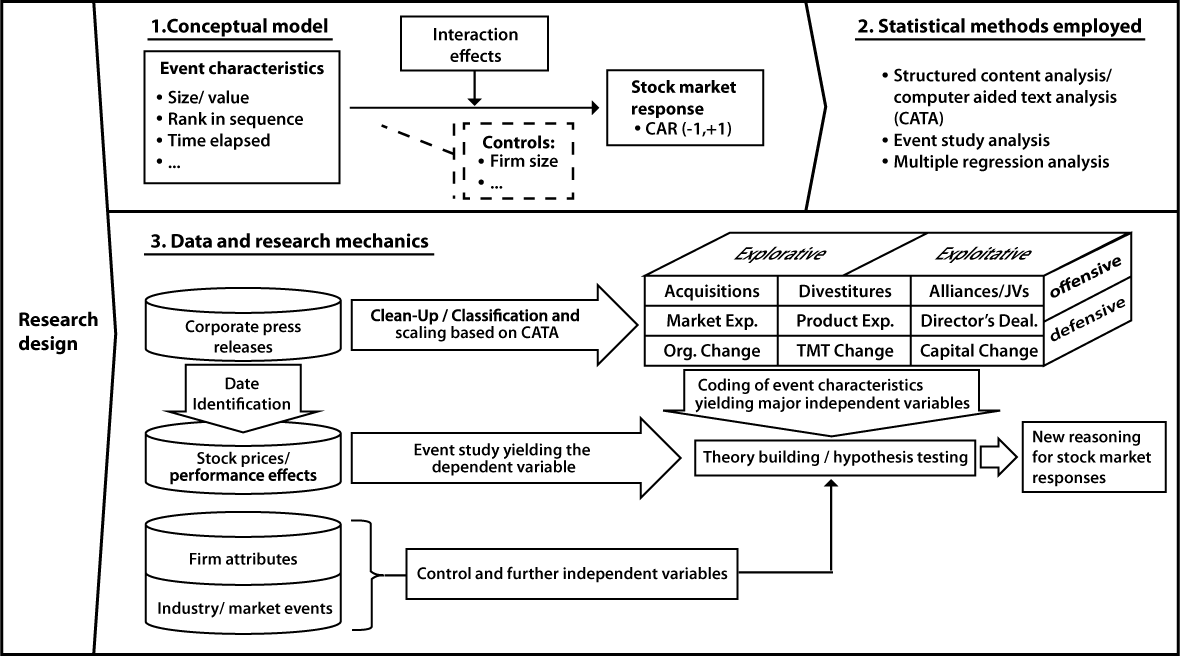

As you will find, most of this work -particularly the earlier one- focused on single event types and drew on secondary databases. Only recently, across event type studies have emerged, and also, the 'sourcing strategy' for events has changed. Given an increasing availability of approaches to harvest unstructured Internet resources in an effort to distill event characteristics that may have a bearing on firms' stock prices, more creative research is entering the stage. Figure 1 below provides a generic research model that describes the mechanics of many event studies.

Figure 1: Mechanics of Event Study Research

References

Bhagat, S. and Romano, R. 2002a. 'Event studies and the law: Part I: Technique and corporate litigation'. American Law and Economics Review, 4(1): 141-168.

Bhagat, S. and Romano, R. 2002b. 'Event studies and the law: Part II: Empirical studies of corporate law'. American Law and Economics Review, 4(2): 380-423.

Bhagat, S. and Romano, R. 2007. 'Empirical studies of corporate law', Handbook of law and economics, Vol. 2: 945-1012. Amsterdam: Elsevier.