Business and Legal Applications of Event Study Methodology and News Analytics

The event study methodology has several meaningful practical applications. The most common ones are listed hereafter:

- Security fraud litigation: In security fraud litigation cases, the event study methodology is frequently used to discern whether information that has been used in an allegedly fraudulent action was relevant to investors, and to determine the value of the information (you may visit this related video for further details). It thus serves to establish materiality and calculate damages. Over the recent decades, the method has become an increasingly important instrument to defendants and plaintiffs in private suits and SEC enforcement actions (Mitchell and Netter, 1994).

- Financial market regulation / reverse event study: Regulators can use the method to systematically monitor stocks for potential security fraud cases. To do so, regulators can apply the event study methodology in a reverse manner: First, they systematically monitor stocks for unusual price movements, then they investigate news data in an attempt to understand the price movements. The monitoring for price movements may take a two-level design, with annual data being first analyzed before high-frequency/intraday data is then used to exactly pinpoint the time of an unusual stock movement.

- Corporate compliance: A classic application relates to a firm-internal topic, corporate compliance. For key corporate events (e.g., an acquisition or a divestiture), event studies reveal important information on how the capital markets have absorbed the new information pertaining to the respective event. Investigating the plot of abnormal returns will give an indication on whether information has leaked prior to the announcement of the event or whether insider trading might have taken place.

- Narratives on capital market implications of events: The abnormal returns of a stock over an extended period of time illustrates how capital markets assess the actions of a company. This capital market perspective provides a useful angle in creating narratives on corporate strategies surrounding such topics.

- Financial performance management / corporate communications: In a similar vein, companies can make use of the capital market perspective. They can monitor how the capital markets react to the firm's stream of corporate actions. Explicit knowledge of the determinants of stock market responses to the respective actions and their associated press releases can inform firm management and corporate communication workers about the factors that contribute to a favorable reception by the capital market.

- Strategy assessment: Knowledge about how the capital markets reacted upon a distinct press release (which generally represents a competitive action/decision) is valuable for surveying investor sentiments and thinking. It provides an indication of how investors perceive individual competitive moves of the firm in light of the firm’s strategy and past behavior. Stock market responses may then serve as a benchmark for the legitimacy of the firm’s decisions.

- Competitor analysis: Applications of the event study methodology can also be used for corporate intelligence. Studying the firm's stock market responses to strategic decisions of rivals (i.e., press releases of these decisions) can reveal the sensitivity of the focal firm to its rivals. This may prove useful in two respects. (1) It helps identify the core competitors from the perspective of the capital markets; (2) It may help managers gauge the impact of rival's strategic decisions on their own firm as perceived by the capital market.

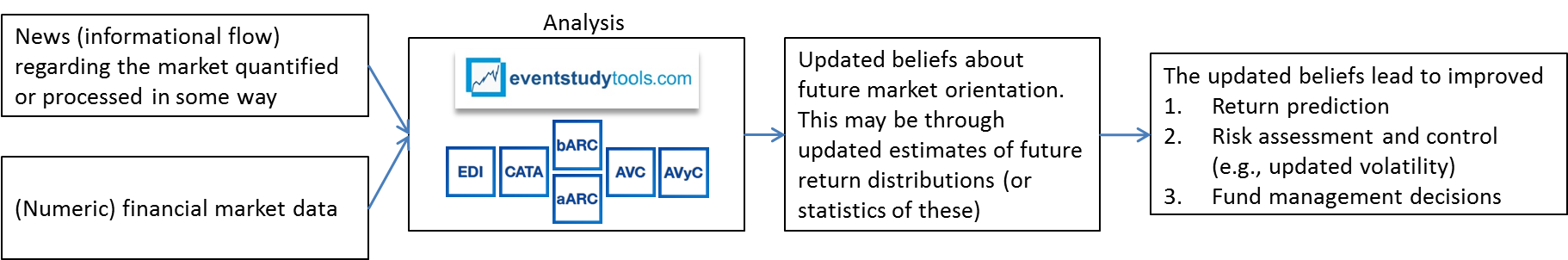

- Financial decision making/investment management: News analytics and event studies bridge qualitative and quantitative aspects of investment management. These methodologies have informed several investment management applications, such as CapitalIQ, Ravenpack, or AlphaFlash. Using these market solutions, event-driven investment managers and hedge funds seek alpha returns for their investors.

Figure 1: How EST-Research Apps Support Financial Decision Making

Adapted from Mitra and Mitra (2011): 3

- M&A advisory: Event studies can also be used as a supplement for traditional analysis of comparable transactions in M&A pitch books. While prevalent comparable transaction analysis focuses on valuation multiples of similar transactions, event study methodology may help to gain a better understanding of how the market reacted to announcements of similar transactions for both the targets and the acquirers. Including this information might facilitate communication with client management as well as improve decision-making on a wide range of topics (e.g., bidding strategy).

- Anomaly detection in non-equity assets: Technically, the event study methodology detects anomalies in time series data. While It has been particularly advanced for the analysis of stock returns and trading volumes, it can also be applied to other types of data. The main criteria for whether it can be applied is whether the to-be-studied time series is having a strong correlate that typically drives its evolution to a significant amount (i.e., in the sense how broad stock market developments are impacting the values of analyzed stocks).