Instructions Event Study Calculators

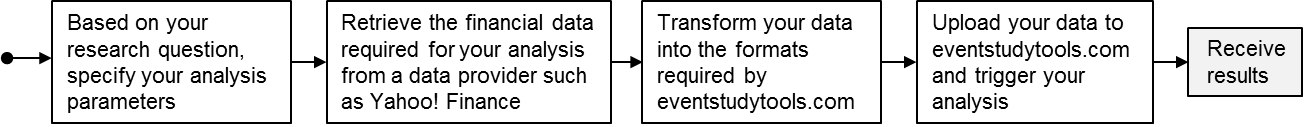

Our advanced Event Study Calculators (AXC) simplify the process of conducting event studies and calculating associated test statistics. We support two types of event studies: return and volume. Correspondingly, we offer the Abnormal Return Calculator (ARC) and the Abnormal Volume Calculator (AVC). These self-service tools operate as shown in the workflow diagram below (Figure 1). For additional guidance, also as audio read-out, we have written a Medium-article on How to perform a Return Event Study using EventStudyTools.

To use our calculators, you’ll need to upload three files containing the necessary data for your analysis. Once the files are uploaded, the statistical analysis is performed server-side, and the results are sent to you via email. The required files include an analysis request file, which specifies the parameters of your study, a firm data file, which contains the financial data for the firms involved, and a market data file, which holds the corresponding capital market data.

Files should be submitted in CSV format (standard, not UTF-8) or Excel (XLS, XLSX). If you’re working with large datasets, ZIP compression is supported. You can retrieve the financial data needed for the firm and market data files from sources like Yahoo! Finance or similar data sources.

Figure 1: Event Study Workflow of EventStudyTools

Your three input files must structure your input data in a certain way. Only then can our event study calculators process the files correctly. As per your event study type (i.e., return, volume, or volatility event study) and benchmark model, the required structure is different. Please find below tables that describe for each calculator and benchmark model the required input file structures, as well as the produced result/output files. The following zip archives with sample input files may help you in constructing your own input files:

- For the Abnormal Return Calculator (ARC), please download these example ARC input files. The zip file holds in its root folder one set of files that works for the market model, the market adjusted model, and the comparison period mean adjusted model. Alternative market data files for the CAPM and the Fama-French 3-, 4-, and 5-factor models are in sub-folder 03_MarketData_Other Models.

- For the Abnormal Volume Calculator (AVC), please download the following example AVC input files.

Results are presented to you in Excel and TXT file format. Please find a sample output set here. Note that the "Results Table Export"-file at this point only exists for ARC.

| CSV | BENCHMARK MODEL | ITEMS TO BE INCLUDED (TO BE SEPARATED BY A SEMICOLON ) |

|---|---|---|

| Request File | Same structure for all models | Event ID1; Firm ID1; Market ID1; Event Date2; Grouping Variable3; Start Event Window4; End Event Window4; End of Estimation Window4; Estimation Window Length |

| Firm Data | Same structure for all models | Firm identifier; Date; Closing price |

| Market Data |

All models but factor models (i.e., CAPM, Fama French 3, 4, and 5 Factor Models) |

Market identifier; Date; Closing price |

| CAPM | Market identifier; Date; Closing price; Rf5 | |

| Fama-French 3-Factor Model | Market identifier; Date; Closing price; Rf5; smb; hml | |

| Fama-French Momentum-4-Factor Model | Market identifier; Date; Closing price; Rf5; smb; hml; umd | |

| Fama-French 5-Factor Model | Market identifier; Date; Closing price; Rf5; smb; hml; rmw; cma |

1Please use integer values for the event IDs; make sure each line in your request file holds a unique ID. There is no specific format you have to follow for firm and market IDs; just make sure that the identifiers you use in the firm and market data CSVs match the ones you use in the analysis request CSV.

2The dates you provide, however, need to be in a distinct date format. Please use either YYYY-MM-DD (default of Yahoo!Finance) or DD.MM.YYYY (Excel default in many countries). If you should use a date format different from these two, the ARC will prompt an error message in its report.

3For generating the 'average' values in your analysis (i.e., AAR and CAAR values as produced by aARC), you need to specify the 'grouping variable'. If you use only one value in the grouping variable, which is the default case, AXC will calculate the average values across all events in your request file; if you choose more than one value (e.g., 'acquisition' and 'divestiture' in a boundary choice study), AXC will produce average values across the events grouped by these values.

4These variables hold figures relative to the event date. ‘Start Event Window’ and ‘End Estimation Window’ are before the event date, therefore, must have a negative sign or be zero. Ranges of allowed values: ‘Start Event Window’: [-50, 0]; ‘End Event Window’: [0, 50], the event window must be larger than 1 day so that the test statistics can be calculated; ‘End Estimation Window’: [-unlimited, -1]; you may choose any (positive) length of the estimation window.

5When providing the risk-free return, make sure to give the per day value in decimal format as it applies in the market/country you study. See our page on data sources for guidance on where to retrieve this data.

General notes: A size limit of approximately 5MB applies to each input file - you can zip individual files before uploading. Additionally, the GUI can process up to 1k events in a single event study, the API handles up to 4k events. The preferred decimal separator for closing prices is the dot. Once you uploaded the data, be patient as the calculation may require up to several minutes depending on your sample size.

| OUTPUT FILE | ITEMS REPORTED1 (SEPARATED BY A SEMICOLON) |

|---|---|

| AR Results | Event ID; ...; AR(-1); AR(0); AR(1); ...; t-value [AR(-1)]; t-value [AR(0)]; t-value [AR(1)]; ... |

| AAR Results |

Columns: Sub-Sample (as defined by grouping variable); Variables; Days Relative to Events (e.g., -10, -9, ..., 0, 1, ... 10 for a -10 to 10 event window) |

| CAR Results | Event ID; Window; CAR Value; CAR t-test |

| CAAR Results | Grouping Variable; CAAR Type; CAAR Value; Precision Weighted CAAR Value; ABHAR; pos:neg CAR; Number of CARs considered; CAAR Pattell Z; CAAR t-test; CAAR GSIGN-Test; CAAR BMP; CAAR GRANK T; CAAR adjusted Patell; CAAR adjusted BMP; CAAR GRANK Z; CAAR skewness adjusted T; ABHAR T; ABHAR skewness adjusted T |

| Analysis Report | Event ID; Firm; Reference Market; Event Date; Analysis Report; Estimation Window Length; End of Estimation Window; First Date Estimation Window; Last Date Estimation Window; Actual Stock Return; Actual Market Return; Alpha; Beta; Residual Standard Deviation; Expected Market Return |

| Results Table Export | TXT file formatted in the style of how you will need to present the results in an academic paper. |

1Test statistics are reported together with p-values

| CSV | BENCHMARK MODEL | ITEMS TO BE INCLUDED (SEPARATED BY A SEMICOLON ) |

|---|---|---|

| Request File | Same structure for all models | Event ID; Firm ID; Market ID; Event Date; Grouping Variable; Start Event Window, End Event Window, End of Estimation Window, Estimation Window Length |

| Firm Data | Same structure for all models | Firm identifier; Date; number of shares traded; outstanding share of the firm |

| Market Data | only required for the market model |

Market identifier; Date; log of mean percentage of trading volume of the index1 |

| OUTPUT FILE | ITEMS REPORTED (SEPARATED BY A SEMICOLON) |

|---|---|

| AV Results | Event ID; ...; AR(-1); AR(0); AR(1); ...; t-value [AR(-1)]; t-value [AR(0)]; t-value [AR(1)]; ... |

| AAV Results |

Grouping variable; ...; AAV(-1); AAV(0); AAV(1); ... |

| CAV Results | Event ID; Window; CAV Value; BHAV Value; CAV t-test |

| CAAV Results | Grouping Variable; CAAV Type; CAAV Value; Precision Weighted CAAV Value; ABHAR; pos:neg CAV; Number of CAVs considered; Patell Z; Csect T; Generalized Sign Z; StdCSect Z; Rank Z; Generalized Rank T; Adjusted Patell Z; Adjusted StdCSect Z; Generalized Rank T; Skewness Corrected T; ABHAR Csect T; ABHAR Skewness Corrected T |

| Analysis Report | Event ID; Firm; Reference Market; Event Date; Analysis Report; Estimation Window Length; End of Estimation Window; First Date Estimation Window; Last Date Estimation Window; Actual Stock Volume; Actual Market volume; Alpha; Beta Residual Standard Deviation; Expected Market Return; First-order Autocorellation |

| CSV | ITEMS TO BE INCLUDED (SEPARATED BY A SEMICOLON ) |

|---|---|

| Request File | Event ID; Firm ID; Market ID; Event Date; Grouping Variable2; Start Event Window3, End Event Window3, End of Estimation Window3, Estimation Window Length |

| Firm Data | Firm identifier; Date; Closing price |

| Market Data |

Market identifier; Date; Closing price |

| OUTPUT FILE | ITEMS REPORTED (SEPARATED BY A SEMICOLON) |

|---|---|

| AVy Results | |

| Event ID; ...; AVy(-1); AVy(0); AVy(1); ...; | |

| AAVy Results |

Grouping variable; ...; AAVy(-1); AAVy(0); AAVy(1); ... |

| Analysis Report | Event ID; Firm ID; Reference Market; Event Date; Analysis Report; Estimation Window Length; End of Estimation Window; First Date Estimation Window; Last Date Estimation Window; Alpha; p-value; Beta; p-value; Gamma; p-value; Delta; p-value; H_i; preLambda; postLambda; Abnormal Return on Event Day; Residual Standard Deviation; Expected Stock Return; Autocorellation |